3 Steps to Increasing Profitability in Your Business

Jul 30, 2021

I've always loved numbers. As a child, I can remember how much fun it was to fill out that Girl Scout Cookie form as I sold boxes of deliciousness to my family and friends. Every day made me more motivated and determined to reach my goals.

As a business owner, have you ever wished keeping up with all of the key numbers in your business was a simple as filling out a Girl Scout Cookie Form?

As a business owner, maybe the only number you are tracking is revenue. Or, you find numbers overwhelming, because expenses and receipts and tax information make your head spin.

Knowing what numbers to track is key to building a profitable business. It not only gives you a goal or destination to shoot for, but it makes you aware of areas that need your focus so that you can make adjustments.

But, tracking all of the key numbers for your business can be a challenge! What numbers should we be tracking anyway and how do we keep it organized?

Here's one of the most important questions...

Is Your Business Profitable?

The only way to know the answer to this question is to have a complete overview of your revenue (sales generated from your business) and your expenses (operation and business costs).

Keeping track of your expenses is not just for tax purposes. It determines your profit margin. Keep reading to learn more.

Now there are awesome tools and software out there that help you track your revenue and expenses. Simply connect your business checking and/or credit card accounts to a tool like Quickbooks, Freshbooks, or Wave. (Wave even offers a FREE version.)

But, the key is to use this information to make decisions and adjustments in your business so you can INCREASE your profit margin.

For 17 years I did not have a good system for tracking this information. Receipts were thrown into a shoebox and the only number I ever looked at each month was how much I was selling. Sales and revenue do not equal profitability!

Example 1: Revenue of $100K - $75K in expenses = $25K profit

Example 2: Revenue of $75K - 25K in expenses = $50K profit

Which would you prefer?

We've all seen the posts on social media when someone hits a key milestone like $100K in revenue. But, the better milestone to celebrate is your PROFIT number. What did you earn AFTER expenses.

So what are the 3 STEPS to Increasing Profitability in Your Business?

1. Make a Plan

- Where are you now?

- Where do you want to go?

- What will it take to get there?

These are 3 questions I ask myself yearly, quarterly, monthly, and weekly in my business.

Need more revenue to reach your goals?

Consider these revenue opportunities:

- Digital Products

- Online Courses

- Physical Products

- eBay, Etsy, Poshmark, FB Marketplace

- Direct Sales/Network Marketing

- Coach or Consultant

- Service Provider

- Affiliate Marketing

There are so many ways to add additional streams of revenue to your life and business.

Don't stay stuck in what "you've always done". THINK outside of the box!

2. Know Your Numbers

How much money do I have coming in and how much money is going out?

Revenue - Expenses = Profit

Profit / Total Revenue = Your Profit Margin

So $100K in Revenue - $50K in Expenses = $50K Profit

$50K Profit / $100K in Revenue = 50% Profit Margin

What profit margin should you shoot for?

This varies depending on your niche and business model. Some businesses would be thrilled to have a 10% profit margin. There may be a lot of operating costs in their business model, but they are generating millions of dollars in revenue yearly therefore still bringing in a profit.

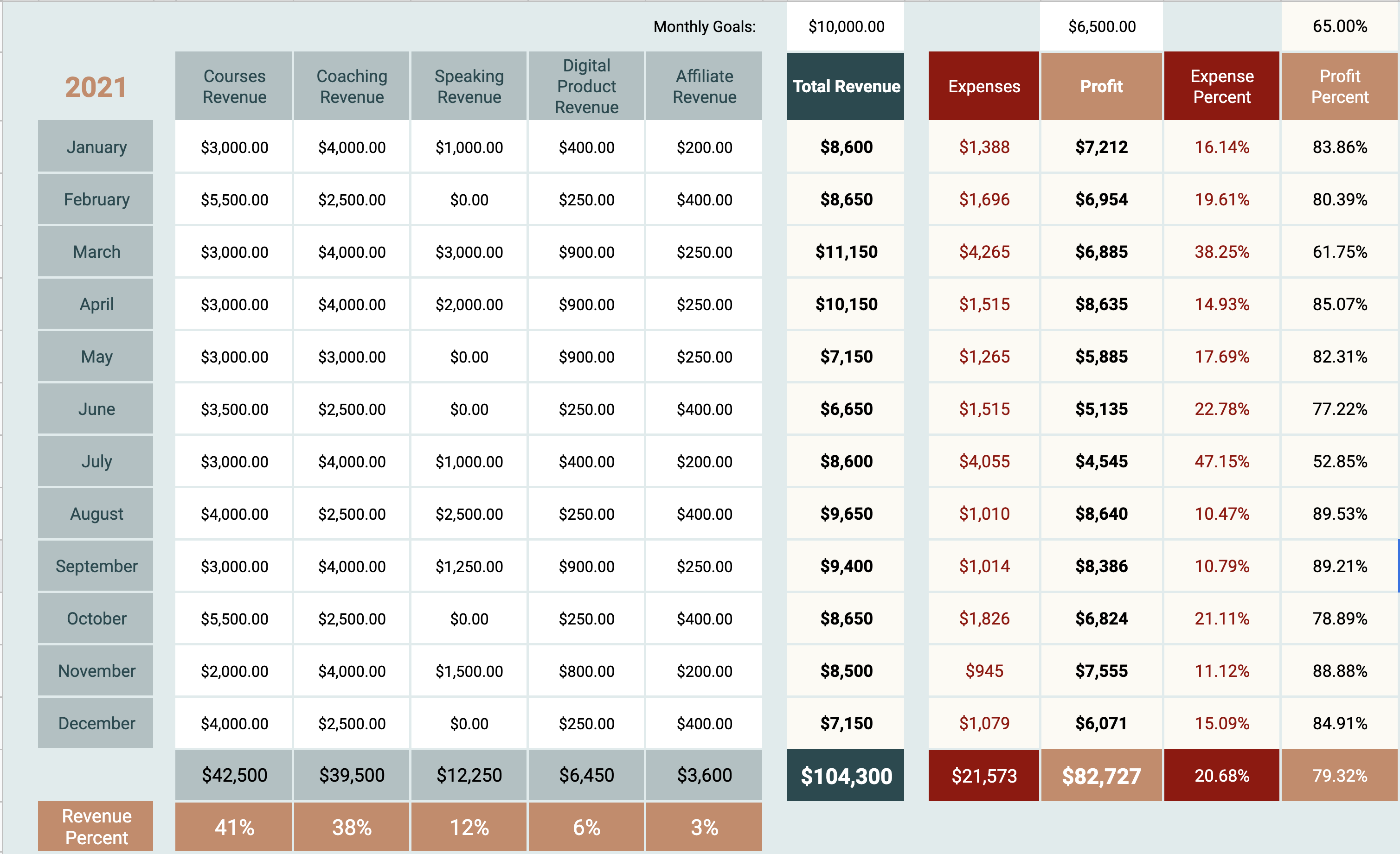

As a course creator and coach, I've set a personal goal of 65%. Some can and will have an even higher profit margin.

That means for every $10K of revenue I generate, I want to make sure at least $6,500 is going into my pocket after advertising, contractors, supplies, office expenses, etc.

With this money I pay myself then I put aside the remainder for taxes and business investments I want to make in the future (new equipment, professional development, etc).

So instead of just focusing on my revenue goals. I also have a profit goal and a profit margin goal. By tracking this information it helps me set goals and make adjustments so I can continue to increase my business profitability.

So many business owners that I've worked with over the years have never taken the time to figure this out. And I get it. Without a tool or guide, where do you start?

Keep reading, because I put together something that will help gather the key information so you can make informed decisions too.

But first, let's go to Step 3.

3. Analyze & Adjust

This is key to knowing your profitability and how to increase it.

Once you know your numbers and have been tracking over time you can now look at your reports and see... what do I have to do to hit the profit goal that I have set?

The goal is to keep more of what you make!

This brings me to the tool I have created that will help you keep up with all of your tracking...the Business Profitability Tracker.

This tool will track your revenue, expenses, and profit margin in an amazing customizable easy-to-use Google sheet!!

Here's how it works...

It allows you to enter your monthly revenue goal & your monthly profit goal.

Here's an example with random data:

Enter your revenue amounts from any source and it automatically adds it up for you!

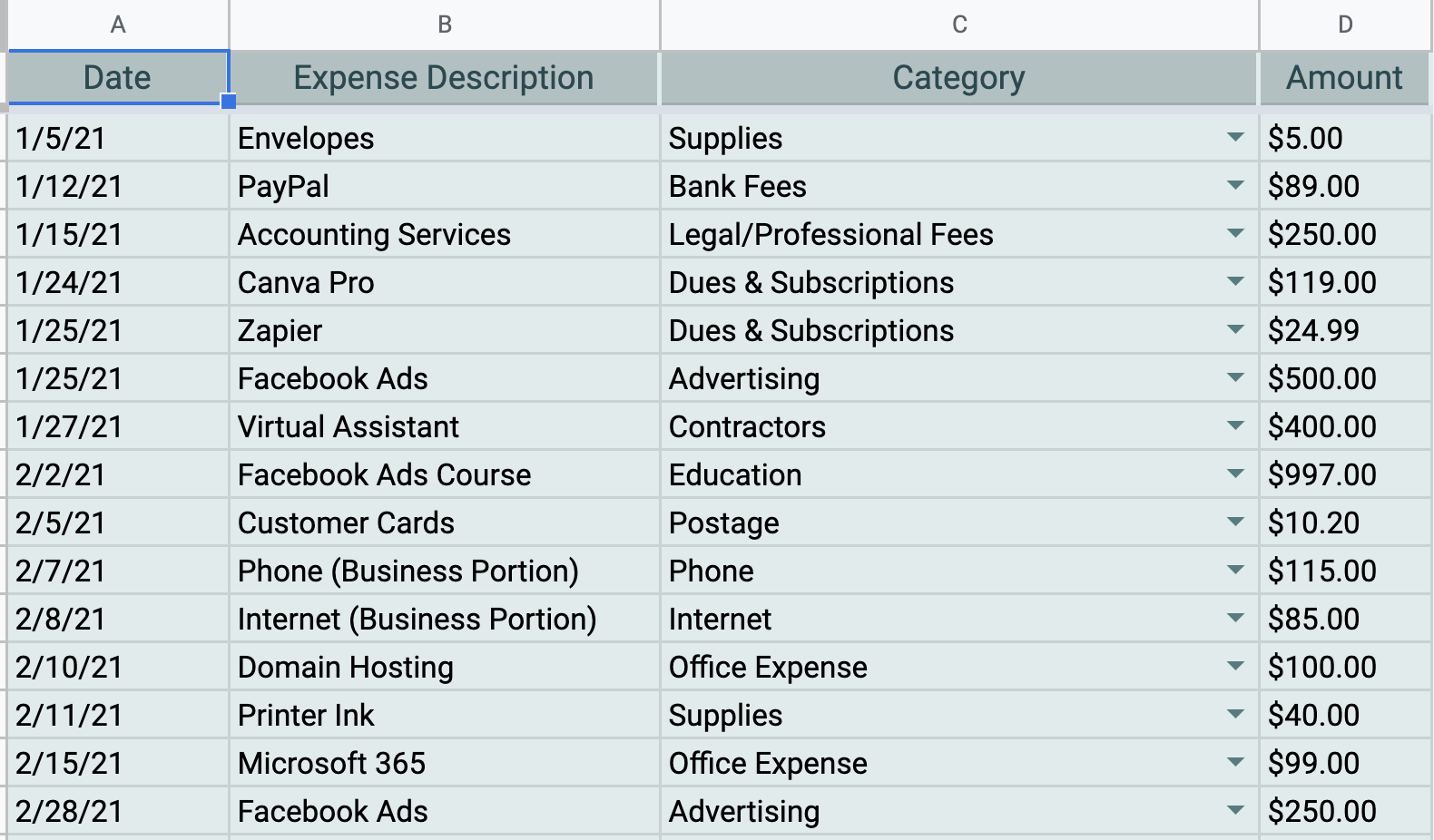

BUT what about EXPENSES??? Where do I track those?

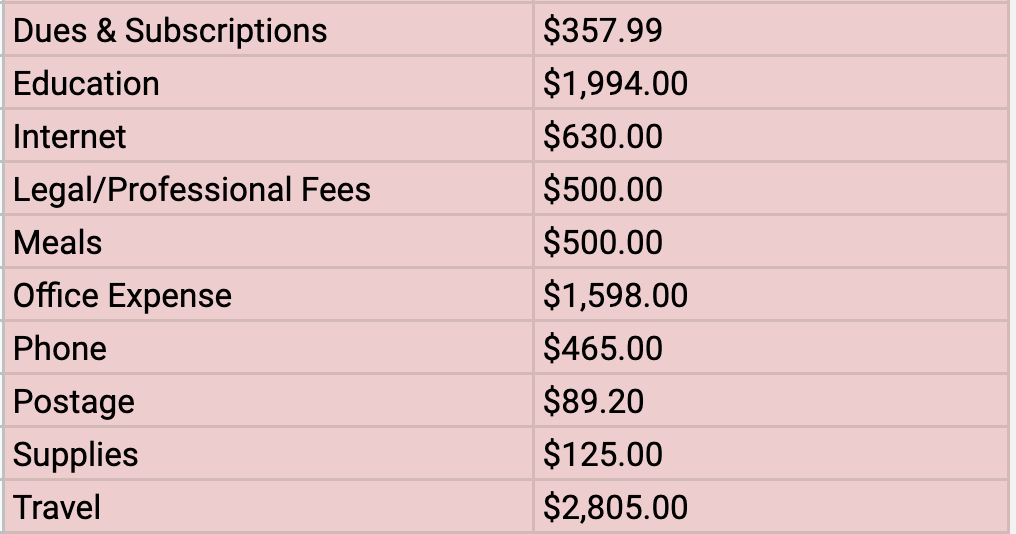

In an Expense sheet, you can set up a category list of ALL your expenses. You will have the date, description, category, and amount. All of these expenses will then automatically add up and import onto your monthly goal sheet.

With your expenses automatically added to the monthly goal sheet, you will be able to see your profit margin.

On this dashboard that is automatically generated as you plug in the numbers, it will show you the year-to-date numbers at a glance. Your total revenue, expenses, profit, expense percentage, and profit margin with charts.

You will automatically see the months that you met your goals and the months that you didn't. AND it will also show the percentages of ALL your revenue sources.

BUT there is MORE...it will show the profit vs goal per month and the profit margin vs goal per month so you can easily see what adjustments may need to be made. HOW cool is this???

Also included are a monthly expense report and a Year-To-Date Expense Report. This makes tax time a breeze!

Can you see how a tool like this would impact your business??

So if you've been using a shoebox as your method for tracking numbers...now you can take those receipts and put them into the Business Profitability Tracker and everything will be added up for you.

The Business Profitability Tracker comes with a getting started tutorial that will give you step-by-step instructions on how to use it in your business!

Knowing your numbers and making a plan is the first step to increasing profitability in your business. Go ahead and take that first step!

Lydia xo

Want to be updated when new episodes are released?

Simply enter your email below!

We keep emails safe and spam free.